36+ debt to income ratios for mortgages

Take Advantage And Lock In A Great Rate. 1 2 For example.

:max_bytes(150000):strip_icc()/GettyImages-463012867-572e2cbb5f9b58c34c8fa655.jpg)

What Is A Good Debt To Income Dti Ratio

Web Here are debt-to-income requirements by loan type.

. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Find Out how much your home is Worth with Randy Beneduce. Web DTI Debt Income.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Use NerdWallet Reviews To Research Lenders. Web What is a high debt to income ratio mortgage.

Take Advantage And Lock In A Great Rate. If your home is highly energy-efficient. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Get Instantly Matched With Your Ideal Home Loan Lender. Compare Now Find The Lowest Rate. Lenders prefer you spend 28 or less of your gross monthly income on.

Web In general lenders prefer that your back-end ratio not exceed 36. Web With respect to Home Loans for High Debt Ratio Reducing debt is another way to improve your debt to income ratio. See How Much You Can Afford.

Debt to income ratios take into consideration. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Ad Compare Home Financing Options Online Get Quotes.

It Only Takes Minutes to See What You Qualify For. Compare Home Loan Options And Find The Best Fit For You. Estimate your monthly mortgage payment.

4000 Debt 10000 Income 40 DTI What is a Good Debt-to-Income Ratio Ratio. Web For example if your monthly debt equals 2500 and your gross monthly income is 7000 your DTI ratio is about 36 percent. DTI ratio under 36 is.

Ideally lenders prefer a debt-to-income ratio. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes. Ad Find Out how much you can Save on your home Mortgage with Randy Benedict.

What factors make up a DTI. Ad More Veterans Than Ever are Buying with 0 Down. Heres how lenders typically view DTI.

The rule says that no more than 28 of your gross monthly income. Apply for Your Mortgage Now. Web If youre looking to buy a home its important to understand your debt to income DTI ratio.

Youll usually need a back-end DTI ratio of 43 or less. View Ratings of the Best Mortgage Lenders. Ad Realize Your Dream of Having Your Own Home.

Web To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. Web When your debt to income ratio is high its important to know what options you have when looking to purchase or refinance your home. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage.

Web Lenders view a DTI under 36 as good meaning they think you can manage your current debt payments and handle taking on an additional loan. Follow along with this tutorial to find out how to calculate y. Ad Learn More About Mortgage Preapproval.

Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Browse Information at NerdWallet. Ad Learn More About Mortgage Preapproval.

Compare Rates of Interest Down Payment Needed in Seconds. Estimate Your Monthly Payment Today. That means if you earn 5000 in monthly gross income your total debt obligations should be.

Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. A high debt to income DTI ratio is any mortgage scenario that exceeds 50 DTI. Your DTI shows lenders how much of your monthly income goes toward paying.

Browse Information at NerdWallet. Web When reviewing a loan application lenders consider an applicants debt-to-income ratio or DTI. DTI between 3643 In this.

Use NerdWallet Reviews To Research Lenders. Ad See how much house you can afford. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More.

Debt To Income Dti Ratio Requirements For A Mortgage

Debt To Income Dti Ratio Calculator Money

What S An Ideal Debt To Income Ratio For A Mortgage

Debt To Income Ratio For Mortgages Explained

Presentation Htm

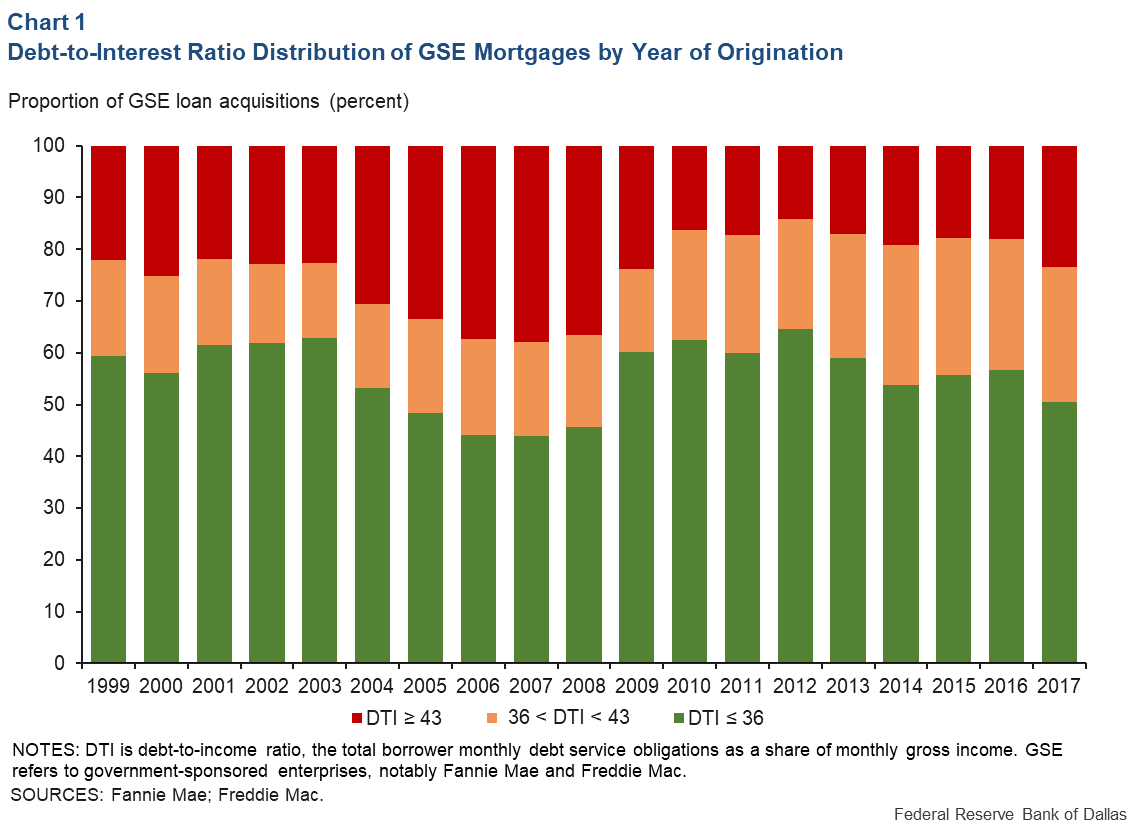

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Debt To Income Ratio Calculator How It Affect Mortgages Moneygeek

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio For Mortgage Definition And Examples

What Is The Debt To Income Ratio For A Mortgage Freeandclear

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Need A Mortgage Keep Debt Levels In Check The New York Times

36 Sample Letter Of Explanation Templates In Pdf Ms Word

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Dti Ratio Requirements For A Mortgage